👋 Hey friends,

A few weeks ago, I hopped on a call with a product manager who’d just wrapped another marathon day.

He sighed and said,

“Every update meeting feels the same — we spend more time reporting what AI did than talking about what we should do next.”

That line stuck with me.

Because beneath all the noise about AI replacing people, something more interesting is happening — AI is reshaping the nature of work itself.

Not by making humans obsolete, but by reshuffling where human creativity actually matters.

We’re living through a once-in-a-century re-architecture of work.

The people who can coordinate, translate, and reason with AI — not just use it — are quietly becoming the most valuable in every room.

Here’s what we’re exploring today:

Why the “AI kills jobs” narrative misses the point — and what the data really says.

The new job clusters emerging across AI product ops, automation, strategy, and human-AI design.

A practical playbook to help you position yourself before the market catches up.

A glimpse into the future of work — what careers will look like when every team has an AI copilot.

Grab your coffee.

By the end of this issue, you’ll see the future of work not as something to fear but as something you can design around yourself.

— Naseema Perveen

IN PARTNERSHIP WITH MASTERWORKS

But what can you actually DO about the proclaimed ‘AI bubble’? Billionaires know an alternative…

Sure, if you held your stocks since the dotcom bubble, you would’ve been up—eventually. But three years after the dot-com bust the S&P 500 was still far down from its peak. So, how else can you invest when almost every market is tied to stocks?

Lo and behold, billionaires have an alternative way to diversify: allocate to a physical asset class that outpaced the S&P by 15% from 1995 to 2025, with almost no correlation to equities. It’s part of a massive global market, long leveraged by the ultra-wealthy (Bezos, Gates, Rockefellers etc).

Contemporary and post-war art.

Masterworks lets you invest in multimillion-dollar artworks featuring legends like Banksy, Basquiat, and Picasso—without needing millions. Over 70,000 members have together invested more than $1.2 billion across over 500 artworks. So far, 25 sales have delivered net annualized returns like 14.6%, 17.6%, and 17.8%.*

Want access?

Investing involves risk. Past performance not indicative of future returns. Reg A disclosures at masterworks.com/cd

Why the Narrative About “AI Killing Jobs” Is Wrong

If you scroll through LinkedIn or TikTok for a few minutes, it’s easy to believe we’re heading toward mass unemployment. Clickbait like “The End of White-Collar Work” resonates emotionally, but it misses a bigger, more nuanced picture.

Here’s what the data actually shows:

AI is automating tasks, not work

AI and automation are reshaping how work gets done, but they are not simply eliminating jobs en masse. Multiple major reports show that while certain tasks within jobs are being automated, overall employment demand is shifting rather than collapsing.

For example, the World Economic Forum’s Future of Jobs Report 2025 finds that though many jobs are evolving, the workforce is expected to grow overall by 2030 with new roles and skills emerging. Employers increasingly value a mix of technology fluency and human skills like creative thinking and leadership.

Skilled roles are expanding

AI-related job postings have grown strongly over the past several years. A McKinsey overview suggests that the share of AI-related roles among all job listings has steadily increased, reflecting broader adoption across industries. Software Oasis

LinkedIn research also shows that roles requiring or mentioning AI continue to surface in growth lists, and employers expect AI fluency even in non-technical jobs. Business Insider

Automation displaces tasks, not humans

Skills transformation is rising rapidly: roles that involve repetitive tasks see tooling support, while human judgment, strategy, collaboration, and creativity become more crucial. This echoes academic work showing that demand for cognitive and interpersonal skills increases alongside AI adoption. arXiv

So the real shift isn’t job loss — it’s work redesign. Automation handles routine labor, but humans are still needed where meaning, context, and judgment matter most.

Automation removes labor. Intelligence creates leverage.

We’re entering an era of leverage jobs — roles built around what humans do best when machines do the rest.

The Hidden Data Behind the Boom

The jobs being created today aren’t just coding roles in tech companies. They’re hybrid, cross-functional positions spread across industries.

Here’s what multiple data sources show about job trends in the AI era:

Job Growth Trends

AI-related job listings have surged over the last few years as companies integrate intelligence tools into workflows.

According to labor market reports, AI-related positions have increased significantly since 2018 and continue to rise as a share of total jobs. Thunderbit

LinkedIn data indicates a dramatic jump in demand for AI skills — even if not every job bears “AI” in the title — with AI expectations becoming baseline in many roles. Business Insider

Skill Demand Shifts

Several surveys and job studies highlight skill trends:

AI literacy and broader technological literacy are among the fastest-growing skill demands globally, as human-AI collaboration becomes more common. World Economic Forum Reports

Roles like prompt engineering, machine learning engineering, and AI ethics appear more often on “jobs on the rise” listings, reflecting real employer demand. Medium

Wage premiums are growing for roles requiring AI competencies, even when tasks within jobs are automated. PwC

Sector-Wide Adoption

AI job growth isn’t confined to tech companies:

Healthcare, retail, and other traditionally non-tech sectors are hiring for AI-related and AI-augmented roles as they adopt automation and analytics tools. Thunderbit

Leadership and strategic AI roles have expanded sharply as companies create new positions to guide governance and deployment.

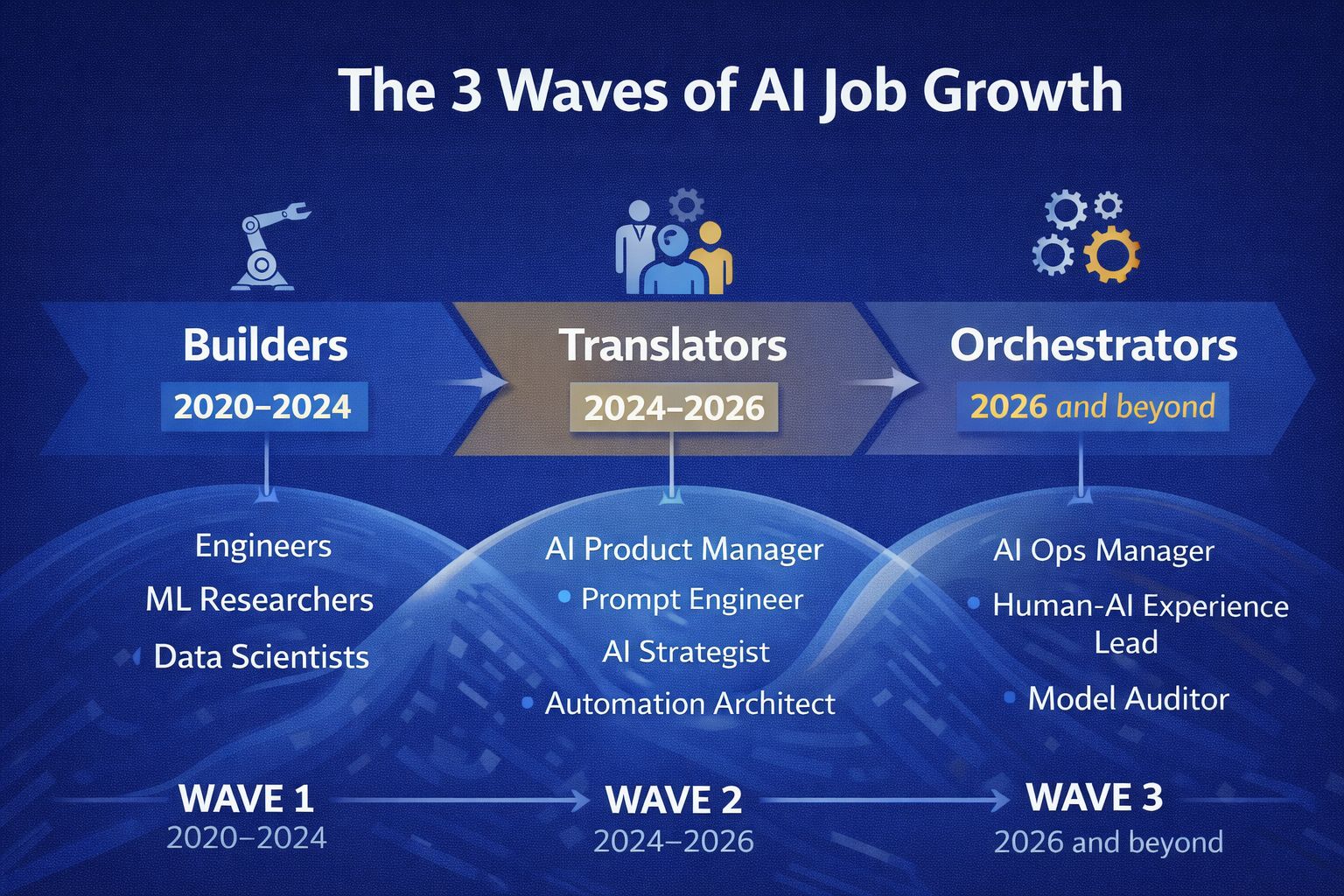

The 3 Waves of AI Job Growth

To understand where this is going, imagine the AI job market as three overlapping waves:

Wave 1 — The Builders (2020–2024):

These were the data scientists, ML engineers, and research teams who built the foundations.

They made AI possible.

Wave 2 — The Translators (2024–2026):

That’s now.

Roles like AI Product Manager, Prompt Engineer, AI Strategist, Workflow Designer, Automation Architect.

They bridge goals with intelligence — defining what problems AI should solve.

Wave 3 — The Orchestrators (2026 and beyond):

These will be the professionals managing AI ecosystems.

They’ll oversee how multiple systems talk to each other, how humans stay in the loop, and how ethics guide automation.

Titles like AI Ops Manager, Human-AI Experience Lead, and Model Auditor will dominate.

Each wave builds on the last.

If Wave 1 built the models, Wave 3 will build meaning.

The Emerging Job Clusters of the AI Economy

When people talk about “AI jobs,” they usually imagine prompt engineers or model trainers — the folks fine-tuning GPTs and running GPU clusters.

But that’s not where the real growth is happening.

The real explosion is in translational roles — the ones connecting messy human goals to powerful, but often unpredictable, AI systems.

These are the people who know how to make AI actually work inside an organization.

And they’re quietly becoming the backbone of the new economy.

Let’s break down the four clusters shaping the future of work — and what skills power them.

1️⃣ AI Product Operations: The Reliability Builders

What it is:

If AI were a factory, these folks would be the quality control line. AI Product Ops teams take promising prototypes and make them usable, testable, and measurable in the real world.

They keep an eye on model drift, monitor accuracy, and constantly tune inputs and outputs so performance doesn’t degrade as data changes.

Why it matters:

Most AI models don’t fail because of bad code — they fail because nobody owns the maintenance.

A 2025 McKinsey analysis showed that 40% of enterprise AI deployments underperform due to missing operational feedback loops.

AI Ops bridges that gap, turning clever prototypes into dependable products.

Growing skills:

Data interpretation

Experiment tracking and A/B testing

Workflow automation

Feedback loop design

Model monitoring and governance

Real example:

A major logistics company used an internal “AI Ops cockpit” to monitor its warehouse prediction models in real time — reducing false predictions by 32% and saving $4M annually.

Average salary (2025): $120K–$160K

In short: these are the people keeping AI honest.

2️⃣ Workflow Automation & Integration: The Connectors

What it is:

These are the no-code architects who make your tools talk to each other. They connect chatbots, CRMs, Slack bots, dashboards, and customer data — without ever writing a line of traditional code.

If AI is the new electricity, automation managers are the electricians.

Why it matters:

Everyone wants “AI productivity,” but very few teams actually get it.

The reason? The glue work is missing.

According to Zapier’s 2025 State of Automation Report, 70% of teams that invest in AI tools never fully integrate them into daily workflows.

Automation architects fix that — turning isolated AI experiments into connected systems that actually deliver ROI.

Growing skills:

System mapping

No-code platforms (Zapier, Make, Relevance AI)

Prompt chaining

Process re-engineering

Data synchronization

Example:

One SaaS company replaced 15 separate manual reports with a single AI-driven dashboard that refreshed nightly and summarized insights in Slack each morning.

It saved 20 hours a week and gave managers a daily pulse on customer churn risk.

That’s one automation manager’s quiet masterpiece.

3️⃣ AI Strategy & Governance: The Translators Between Tech and Trust

What it is:

These are the people asking the most important question in the AI era: why should we build this?

They’re not writing code — they’re setting direction.

AI strategists define business use cases, evaluate risks, align departments, and create policies that make AI adoption both ethical and effective.

Why it matters:

As regulation catches up (think EU AI Act, U.S. AI Bill of Rights), companies can’t just “experiment fast” anymore — they need frameworks for explainability, fairness, and auditability.

That’s why demand for AI policy, governance, and compliance roles is up more than 60% year-over-year, according to The Economic Times (2025).

Growing skills:

Policy and regulatory literacy

Systems thinking

Cross-functional leadership

Communication and stakeholder alignment

Risk management

Bonus insight:

A McKinsey survey found that companies with formal AI governance frameworks outperform peers in ROI by 30% — because clarity beats chaos.

Example titles:

AI Policy Advisor, Chief AI Strategist, Governance Program Lead

These roles are becoming the “COOs of intelligence” — the ones ensuring AI aligns with human values and business logic.

4️⃣ Human–AI Collaboration Design: The Trust Builders

What it is:

The next frontier of design isn’t visual — it’s psychological.

Human–AI collaboration designers craft interfaces, workflows, and feedback systems that help people trust machine outputs.

They’re part designer, part psychologist, part data translator.

Why it matters:

70% of failed AI projects aren’t technical — they fail because humans don’t trust or understand the system’s reasoning.

(That’s from a Stanford HAI study on human–AI adoption, 2024.)

So these designers are solving one of the hardest problems in AI: how to make intelligence feel intuitive.

Growing skills:

UX for transparency

Communication design

Behavioral science

Model explainability

Human factors engineering

Example roles:

AI Interaction Designer

Conversational UX Lead

Human Feedback Architect

Example:

A fintech firm redesigned its fraud-detection dashboard so analysts could see why the model flagged each case.

Trust scores jumped by 45%, and false rejections dropped by half.

That’s what “good design” means in the age of AI — not prettier interfaces, but more explainable ones.

Why These Roles Matter More Than You Think

If you zoom out, all four of these clusters have one thing in common: they sit between systems and sensemaking.

They don’t require you to be a machine learning engineer. They require you to think like a translator — someone who can turn intelligence into action, and automation into advantage.

This is what I call the “Human–AI Leverage Layer.”

It’s where the next decade of meaningful work will happen — because it’s where humans add what machines still can’t: context, creativity, and care.

The Playbook: How to Position Yourself Before the Market Catches Up

If there’s one pattern I’ve noticed this year, it’s this: the people winning in the AI era aren’t the ones learning the most tools — they’re the ones building systems around themselves.

They’re not waiting for a job title to evolve. They’re evolving faster than the job description.

Here’s how to do the same — step by step.

Step 1 — Map Your Value Chain

Start with a simple self-audit.

For one week, write down everything you do. Then label each task with one of three letters:

M (Mechanical) — repetitive, rules-based, predictable.

C (Creative) — expressive, story-driven, judgment-based.

S (Strategic) — forward-looking, decision-oriented, connective.

Now comes the fun part:

Automate the M. Let AI handle the grunt work.

Amplify the S. Use AI as a thinking partner.

Protect the C. That’s your competitive moat.

Think of it as decluttering your brain. Every automated task frees space for deeper work — the kind that compounds.

(Tip: McKinsey found that knowledge workers waste up to 30 percent of their time on “mechanical” coordination. Automating even half of that is like adding an extra workday per week.)

Step 2 — Build an AI-Assisted Workflow

Don’t start with the biggest problem. Start with the smallest habit.

Pick one recurring task — something you do every week — and bring AI into it.

Maybe it’s:

Drafting meeting notes in ChatGPT.

Summarizing customer feedback in Claude.

Having Notion AI cluster your ideas into themes.

The goal isn’t perfection. It’s discovery.

Write down what worked, what broke, and what you learned. Over time, this becomes your personal playbook — a trail of insights that compound.

And if you want to take it up a notch, share it with your team. Most people don’t need a course on “AI productivity.” They need to see one teammate doing it well.

Step 3 — Pair Every Tool with a Human Skill

This is where most people go wrong.

They think the tool is the skill.

But the people who’ll thrive aren’t the ones who master tools — they’re the ones who know how to think with them.

AI Tool | Human Skill | Why It Works |

ChatGPT / Claude | Discernment | Turns data into judgment |

Notion AI | Reflection | Converts chaos into clarity |

Midjourney | Creativity | Turns imagination into visuals |

Perplexity | Curiosity | Deepens understanding through questions |

Zapier | Systems Thinking | Connects isolated workflows into flow |

Call it your Human + AI Stack.

The tech handles execution; the human guides meaning.

You don’t need to out-compute machines. You need to out-interpret them.

Step 4 — Publish, Don’t Just Learn

Here’s something I wish I’d understood earlier: learning is invisible — publishing is leverage.

Everyone’s “learning AI.” But very few people are showing what they’re learning.

That’s your opportunity.

Start small:

Share a screenshot of a workflow you built.

Write a short post on a problem AI solved for you.

Record a 30-second Loom video showing your setup.

It’s not about virality — it’s about visibility.

Publishing makes your growth discoverable. It attracts mentors, collaborators, and (sometimes) recruiters who see the proof, not the potential.

Think of it as open-sourcing your curiosity.

Step 5 — Build Your Personal Operating System

Once you start experimenting, you’ll drown in prompts, workflows, and half-finished ideas.

That’s normal. But it’s also why you need a home base.

Use Notion, Airtable, or even a folder system to store:

Your best prompts (tagged by use-case)

Lessons learned from each experiment

Favorite tools, links, and templates

Ideas that still need testing

Then, every Friday, spend 15 minutes updating it.

This is your second brain — the one that remembers everything you forget and compounds everything you learn.

Over time, that operating system becomes your edge.

You stop reacting to the market and start shaping how it moves.

Final Thought

Everyone’s waiting for AI to “settle” so they can figure out what to do.

But by the time the market catches up, the people who’ve built these systems will already be leading it.

Because the future of work isn’t about knowing more — it’s about building faster loops between learning and doing.

Start your loop this week. One small workflow. One visible output. One better way of thinking.

That’s how careers compound in the age of AI.

What the Future of Work Will Actually Look Like

If the past decade was about “working with technology,” the next one is about “working through technology.”

By 2026, we won’t just see new tools — we’ll see an inversion of what “work” even means.

Yesterday | Tomorrow |

Static job titles | Fluid capabilities |

Siloed departments | Cross-functional ecosystems |

Knowledge hoarding | Knowledge orchestration |

9-to-5 delivery | Continuous feedback loops |

Career ladders | Learning flywheels |

The walls are coming down.

Instead of climbing corporate ladders, people will move through networks of opportunity — assembling projects, partnerships, and workflows around what they do best.

The office will feel less like a hierarchy and more like a living system — a network of humans, AI copilots, and connected workflows.

Each person will manage their own mini-agency, powered by their tool stack, data flow, and judgment.

And here’s the irony: as technology scales, the teams building it will actually get smaller.

Because when intelligence becomes abundant, focus becomes scarce.

What That Means for You

You won’t be measured by how much you can do — but by how quickly you can adapt.

The best people will operate like designers of systems:

spotting friction,

building lightweight automations,

and connecting meaning across silos.

The work itself will be more fluid, but the people who thrive will share one constant trait: they design automation thoughtfully.

They don’t resist AI, and they don’t worship it.

They choreograph it.

The Reflection Loop

The future of work isn’t something to predict — it’s something to prototype.

So take ten quiet minutes this week and walk yourself through these questions:

1️⃣ What part of my work has gotten easier — and what skill does that free me to strengthen?

2️⃣ Am I learning tools, or am I learning how to think with them?

3️⃣ If AI became my teammate, what role would I play better?

4️⃣ What pattern do I see emerging in my industry that no one’s naming yet?

These aren’t productivity questions — they’re identity questions.

Because the biggest shift AI is creating isn’t in our workflows — it’s in who we become when the easy parts disappear.

Closing Reflection

Every industrial shift tells a story.

The steam engine moved muscle.

The computer moved memory.

AI is moving meaning.

The real question isn’t “Will AI replace me?”

It’s “Will I evolve faster than my systems?”

The people who thrive won’t be the most technical — they’ll be the most translational.

The ones who can turn noise into narrative, systems into empathy, and intelligence into insight.

So next time you see a headline about AI killing jobs, remember:

For every task that technology automates, it creates two that demand deeper humanity.

And maybe the next wave of leadership won’t come from people who can code — but from those who can connect.

✨ A Thought to Leave You With

AI isn’t coming for your job.

It’s coming for your old way of working.

And that’s good news — because it means you get to rebuild your career on your own terms.

Start small: pick one workflow, one mindset, one conversation where you bring AI in as a collaborator — not a competitor.

That’s how you future-proof your work.

One experiment at a time.

See you next time,

— Naseema

Writer & Editor, The AI Journal

If AI became your teammate tomorrow, which role would you want to play?

That’s all for now. And, thanks for staying with us. If you have specific feedback, please let us know by leaving a comment or emailing us. We are here to serve you!

Join 130k+ AI and Data enthusiasts by subscribing to our LinkedIn page.

Become a sponsor of our next newsletter and connect with industry leaders and innovators.