👋 Hey friends, TGIF again!

Everywhere I look, people talk about AI like it’s a productivity hack: “ChatGPT saves me 30 minutes on email,” “MidJourney made me a logo.”

I used to think the same. But then I started paying closer attention — and it hit me: the biggest transformations aren’t in the tools we use every day. They’re in the industries we rarely think about but rely on constantly.

Here’s the insight that stopped me: AI isn’t just a tool — in certain sectors, it’s quietly becoming the rulebook itself.

In finance, AI doesn’t just assist traders. It defines the market itself. If you’re not plugged into those systems, you’re not even playing the game.

In healthcare, AI doesn’t just analyze patient data. It changes the physics of what’s possible — shrinking drug discovery from years to months.

In real estate, AI isn’t just valuing homes. It’s shifting trust — with buyers and sellers starting to believe algorithms more than brokers.

In today’s edition, we’ll explore how AI is reshaping these three industries: finance, healthcare, and real estate. I’ll break down what’s already happening, why adoption is lagging, the hidden insights most people miss, and the startup wedges that could unlock the next billion-dollar opportunities.

Let’s dig into it!

IN PARTNERSHIP WITH THE CODE

Find out why 100K+ engineers read The Code twice a week

Staying behind on tech trends can be a career killer.

But let’s face it, no one has hours to spare every week trying to stay updated.

That’s why over 100,000 engineers at companies like Google, Meta, and Apple read The Code twice a week.

Here’s why it works:

No fluff, just signal – Learn the most important tech news delivered in just two short emails.

Supercharge your skills – Get access to top research papers and resources that give you an edge in the industry.

See the future first – Discover what’s next before it hits the mainstream, so you can lead, not follow.

Why this matters

Here’s what I didn’t appreciate until I started writing about AI: technological revolutions don’t just change how we work — they quietly change who gets to set the rules.

The printing press didn’t just spread knowledge faster. It wrestled authority away from priests and scribes and handed it to publishers and the public. The “rulebook” of truth itself shifted.

The internet didn’t just connect us. It collapsed gatekeepers, rewrote distribution, and created entirely new winners (Amazon, Google) while rendering giants like Blockbuster irrelevant.

Mobile didn’t just make the web portable. It rewrote human behavior — attention, habits, even social norms — in ways no one voted on but everyone had to adapt to.

And now, AI is doing something even more radical: it’s rewriting rulebooks in places that most people don’t even see — finance, healthcare, real estate. These aren’t “apps we play with.” They’re the hidden systems that run our economies, our health, our homes.

What struck me most while digging into this newsletter is that the incumbents aren’t actually in control. They hold the data, but they don’t move fast enough. The models are ready, but regulators and trust bottlenecks hold them back. And in that gap, new players slip in — small startups that can reset the terms of the game.

That’s the deeper pattern: whenever the rulebook changes, new winners emerge — not because they out-muscle incumbents, but because they spot the cracks early, before anyone else realizes the rules have already shifted.

Finance: When Markets Become Models

When I first spoke with someone in asset management about AI, they didn’t talk about saving time. They admitted something striking: “We’re not competing with other traders anymore. We’re competing with the models.”

That’s a quiet but massive shift.

Finance has always been about information edges. Whoever processed data faster won. AI just changed that — it’s no longer about speed, it’s about who owns the models that define reality.

Asset Management Under Pressure (McKinsey 2025)

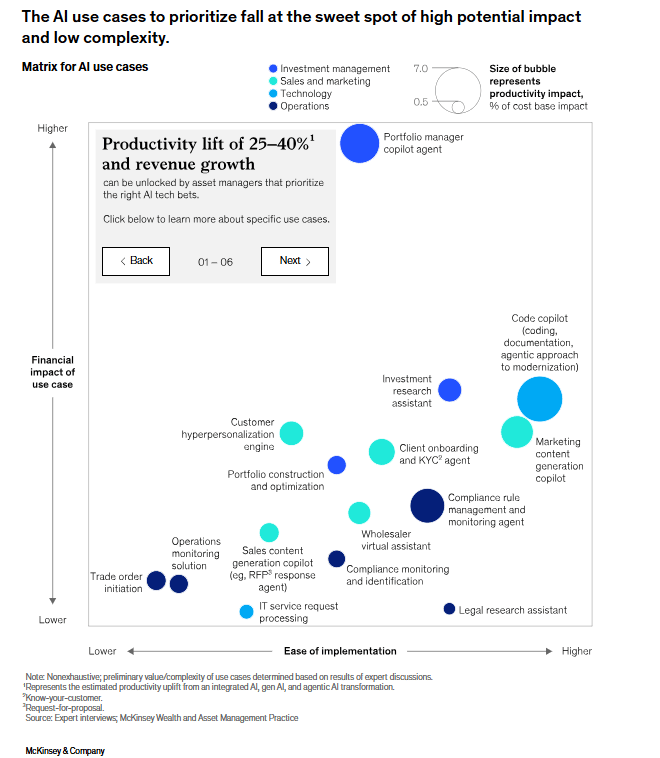

McKinsey’s July 2025 report highlights why AI is more than a buzzword in finance — it’s survival.

Margins have declined by 3 percentage points in North America and 5 in Europe over the past five years. Tech costs surged at ~9% CAGR, but productivity gains never materialized.

AI could unlock 25–40% efficiency in cost base, freeing billions if firms rewire operations end-to-end.

Early adopters are already seeing benefits:

→ Revenue growth from AI-driven portfolio insights and personalized client engagement.

→ Risk reduction through automated compliance monitoring and codified institutional knowledge.

→ Faster workflows, with gen-AI copilots cutting coding cycles and research analysis time by 20–40%.The biggest unlock isn’t piecemeal adoption. McKinsey stresses that true ROI comes when firms pursue domain-level transformation — reimagining investment, compliance, and client management from the ground up.

Asset managers are stuck in a “complexity tax” — overspending on legacy systems while underinvesting in transformation. AI isn’t just a cost-saver; it’s a chance to reset the economics of the industry.

CFO Perspective (World Economic Forum, 2025)

Financial leaders echo this urgency. As Jill Klindt (CFO, Workiva) put it:

“CFOs have evolved to be not only financial stewards, but also strategic drivers of digital transformation. Investing in secure, responsible AI to transform processes and enhance collaboration is strengthening both stakeholder trust and investor confidence.”

This shows that for CFOs, AI isn’t just an efficiency tool — it’s now core to resilience, competitiveness, and credibility in the eyes of investors.

Aladdin: The Invisible Engine of Finance

BlackRock’s Aladdin (Asset, Liability, Debt & Derivative Investment Network) is a perfect example.

It oversees $11.6 trillion in assets (Reuters), running real-time risk analytics and scenario simulations across global portfolios.

It’s not just used by BlackRock — banks, insurers, pension funds, and even governments rely on Aladdin to make investment decisions.

This creates a paradox: BlackRock doesn’t just manage assets, it shapes how others manage theirs. Aladdin has become the invisible brain of global capital, redistributing trust from people to a platform.

Aladdin shows us that AI in finance isn’t just about helping humans — it’s about models becoming the referees of markets themselves.

Startup Wedges

AI-native compliance & audit tools → regulators are tightening scrutiny, startups can move faster than incumbents.

Fraud/anomaly detection as a service → critical as AI-generated fraud losses topped $25B in 2024.

Micro-robo-advisors for niche markets → freelancers, gig workers, small businesses underserved by big finance.

Workflow orchestration platforms → combining human analysts + agentic AI to boost scale and speed.

Healthcare: Collapsing Time, Expanding Access, Scaling Impact

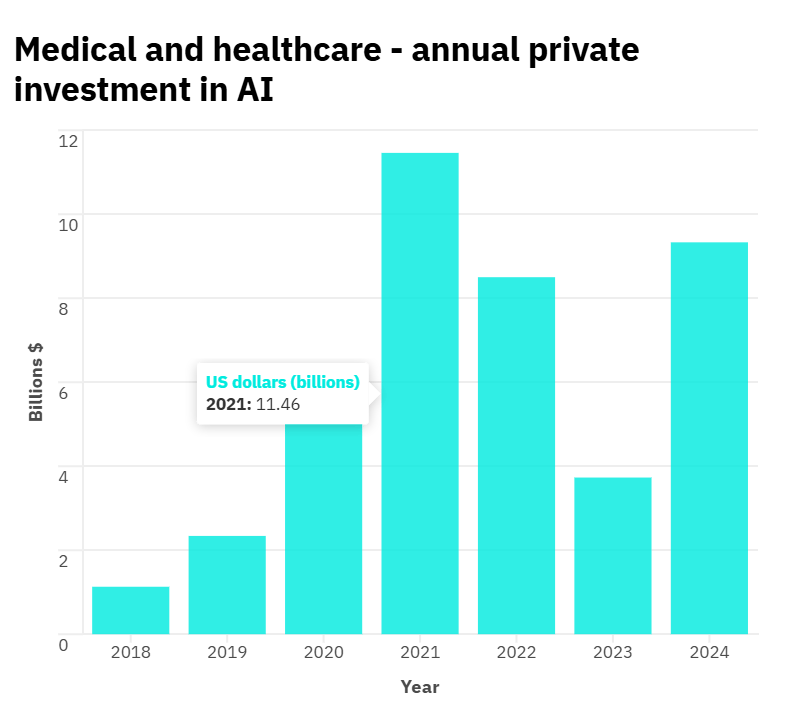

Here’s something I didn’t fully grasp until recently: in healthcare, the scarce resource isn’t just knowledge — it’s time and access. Today, 4.5 billion people lack essential care, and by 2030 the world faces a shortage of 11 million health workers. AI won’t replace doctors, but it can bridge that gap by compressing timelines, extending reach, and reshaping entire systems.

What’s Already Happening

Stroke care → A UK-trained AI system was twice as accurate as doctors in interpreting brain scans of stroke patients, and could pinpoint the critical treatment window.

Fracture detection → Urgent care doctors miss ~10% of fractures. AI models outperform humans in spotting them, validated by the UK’s NICE for safety.

Ambulance triage → In Yorkshire, an AI model predicted with 80% accuracy which patients needed hospital transfers, helping paramedics make life-or-death calls.

Early disease prediction → AstraZeneca’s AI model, trained on 500,000 UK health records, can detect risk of 1,000+ diseases years before symptoms appear — from Alzheimer’s to COPD.

Patient monitoring → Platforms like Huma cut readmissions by 30% and reduced review times by 40%, freeing clinicians to focus on the highest-risk patients.

Admin automation → Microsoft’s Dragon Copilot and Google’s healthcare AI are cutting hours of paperwork, letting doctors spend more time with patients.

Why It’s Not Scaling (Yet)

Despite these breakthroughs, adoption at scale remains slow. The World Economic Forum’s Digital Healthcare Transformation research points to three roadblocks:

Complexity → Policymakers and executives struggle to place AI in health on the strategic agenda.

Misalignment → Technology decisions often don’t match strategic goals, with incentives pulling in different directions.

Low confidence → Public distrust and fragmented regulation leave clinicians cautious about widespread adoption.

Six Shifts Needed for Systemic Impact

To unlock AI’s full potential in healthcare, six transitions must happen:

From breakthroughs → near-term wins: Show immediate ROI (shorter wait times, lower costs) to justify long-term investment.

From private pilots → public–private ecosystems: Align governments, providers, and tech leaders on shared objectives.

From infrastructure battles → service value: Invest in shared digital infrastructures (like health data exchanges) that benefit all stakeholders.

From passive leaders → responsible decision-makers: Upskill health leaders so they can make informed technical choices.

From waiting for rules → building trust: Proactively monitor and explain AI decisions to clinicians, regulators, and patients.

From scattered data → deliberate integration: Build interoperable, patient-centered systems that protect privacy while enabling innovation.

The Hidden Insight

AI in healthcare isn’t just about efficiency. It’s about reshaping the arc of medical innovation and care delivery:

Speed → collapsing discovery cycles from years to months.

Reach → extending quality care to billions who lack it.

Trust → shifting workflows toward AI models that doctors validate rather than originate.

But here’s the catch: AI in healthcare won’t scale through flashy pilots alone. It requires ecosystem-level change — trust, governance, interoperability, and alignment between public and private players. Without that, the transformative potential risks stalling in isolated projects.

Startup Wedges

AI triage bots for hospitals with limited staff, especially in emerging markets.

Clinical trial recruitment engines that cut patient matching from months to days.

Disease prediction APIs using anonymized data for insurers and providers.

AI explainability tools that show regulators and clinicians why a model made a recommendation.

Admin copilots tailored for healthcare systems to free clinicians from paperwork.

Real Estate: Trust Shifts from People to Algorithms

Real estate has always been slow, opaque, and people-driven — deals closed with handshakes, valuations based on gut feel. But AI is rapidly changing that, and the numbers tell the story: the AI in the real estate market hit $222.65B in 2024 and is expected to surge to $975.24B by 2029, growing at a CAGR of 34.1%.

This growth is fueled by two forces:

The IoT surge, embedding sensors into buildings and cities that generate continuous data streams.

A technological leap in automation — from AI-driven valuations to virtual property tours and predictive maintenance.

What’s Already Happening

Valuation & price prediction → Automated valuation models (AVMs) now analyze location, property features, and market data to generate real-time pricing. Zillow’s Zestimate is only the tip of the iceberg.

Customer engagement → Chatbots and AI-powered CRMs personalize property recommendations, analyze buyer sentiment, and qualify leads faster than human agents.

Construction & planning → AI forecasts material costs, predicts project risks, and optimizes design plans.

Property management → IoT + AI platforms automate tenant communication, predict maintenance issues, and optimize utilities.

Visualization → Computer vision powers virtual staging, property image analysis, and AR-based tours, making decisions faster for buyers.

Why It’s Not Scaling (Yet)

Trade wars & tariffs → Rising costs of processors and imaging tools (from Taiwan, Germany) risk slowing adoption of virtual tour platforms.

Data fragmentation → Property data is scattered across multiple silos, limiting the accuracy of models.

Trust gap → Consumers like AI-driven price tools, but regulators and lenders demand explainability before relying on them fully.

Shifts Needed for Systemic Impact

From fragmented → integrated data: Shared, standardized data across geographies.

From black box → transparent AI: Explainable valuation engines to build trust with regulators and investors.

From manual → AI-augmented workflows: Brokers, lenders, and property managers working within AI-first ecosystems.

The Hidden Insight

AI in real estate isn’t just about faster pricing or better chatbots. It’s about redistributing trust — away from brokers and anecdotes, toward algorithms and data-driven systems. And since trust underpins every transaction, this shift is rewriting how properties are priced, financed, and managed.

Startup Wedges

Mortgage risk scoring for gig workers and nontraditional borrowers.

AI-driven tenant screening to cut fraud, defaults, and disputes.

Dynamic leasing models that adapt to hybrid work patterns and occupancy trends.

IoT-integrated property management systems for predictive maintenance and energy optimization.

AI explainability platforms to help regulators, lenders, and buyers understand why a valuation is made.

The Common Thread

After diving into finance, healthcare, and real estate, I realized something that most surface-level takes on AI miss: AI doesn’t just add efficiency — it exposes the cracks incumbents have been patching over for decades.

Incumbents move like glaciers. They have the data and the budgets, but not the agility. That’s why asset managers overspend on legacy IT, why hospitals run on outdated infrastructure, why real estate brokers still cling to Excel. A startup with a sharp wedge can outmaneuver a giant with $10B of sunk costs.

Data is the new gravity. Whoever owns unique, high-quality datasets pulls the rest of the market into their orbit. Aladdin in finance. AstraZeneca’s disease signatures in healthcare. Zillow’s Zestimate in real estate. These aren’t just tools — they’re gravitational wells. Once you’re caught, you move to their tempo.

Humans are the choke point. The models are ready. But regulators, risk officers, and trust gaps keep them fenced in. The bottleneck isn’t compute power — it’s confidence.

💡 And this is exactly where startups wedge in: not by out-modeling the incumbents, but by solving for trust, agility, and distribution where the big players can’t move fast enough.

Startup Playbook: How to Spot the Next Rulebook Rewrite

Here’s the framework I keep coming back to when scanning for the next AI frontier:

Follow the pain. Where are people hemorrhaging time, money, or trust? (Think insurance claims backlogs or trial recruitment bottlenecks.)

Find the opacity. AI thrives in places where sunlight has been missing. Finance hid behind jargon. Real estate behind handshake deals. Healthcare behind complexity. Those industries are ripe.

Check the adoption lag. If the incumbents are still glued to fax machines, mainframes, or Excel macros, AI doesn’t just help — it leapfrogs.

Don’t chase shiny, chase sticky. The most transformative startups won’t be building AI photo filters. They’ll be “boring” products — compliance tools, supply chain monitors, agri-tech optimizers — where once trust is earned, it’s almost impossible to rip out.

Final Thought

The more I map this out, the less I care about the next chatbot demo. What excites me is watching the rulebooks get rewritten in industries most people overlook.

Because when rules change, winners change. And history shows us it’s rarely the incumbents who adapt first. It’s the scrappy outsiders who see the cracks — and move before anyone else notices.

If there’s one truth this AI wave has taught me, it’s this: the real opportunity isn’t in building smarter models, it’s in spotting where trust, data, and inertia are misaligned — and slipping your wedge right there.

That’s how you don’t just ride the wave. You reset the board.

And those are the founders who build the next generation of $10B companies.

That’s all for today’s deep dive. Thanks for reading and thinking this through with me.

Have a great weekend — and I’ll see you next week.

Naseema ✨

SHARE THE NEWSLETTER & GET REWARDS

Your referral count: {{ rp_num_referrals }}

Or copy & paste your referral link to others: {{ rp_refer_url }}

That’s all for now. And, thanks for staying with us. If you have specific feedback, please let us know by leaving a comment or emailing us. We are here to serve you!

Join 130k+ AI and Data enthusiasts by subscribing to our LinkedIn page.

Become a sponsor of our next newsletter and connect with industry leaders and innovators.